Order Top Stub Checks

Top Stub Checks: Check Anatomy And Common Online Order Questions

In general, when you place an order for checks, you can choose from four standard check formats which include top stub checks, side tear checks, single wallet checks, and duplicate wallet checks.

With top stub checks, you will be provided with a stub located on the top portion of each check. This stub makes it easier for you to record your transactions and gets rid of having to refer to the check register each time you use a check. Top stub checks typically come in orders of 150 checks in a box. Side tear checks on the other hand are like single wallet checks but they tear from the checkbook’s left-hand portion and not from the top. These usually come in orders of 125 checks in a box for single checks or 100 checks in a box for duplicate checks.

Single wallet checks are the most common check format that tears from the top of your checkbook. Like top stub checks, these types of checks also come in orders of 125 checks in a box. Duplicate wallet checks are like single wallet checks and top stub checks minus the provided stubs. With this check format, all checks you write out will automatically create a copy. This is very convenient since you won’t ever have to record each check transaction that you write out. These come in orders of 100 checks in a box.

• Check Anatomy

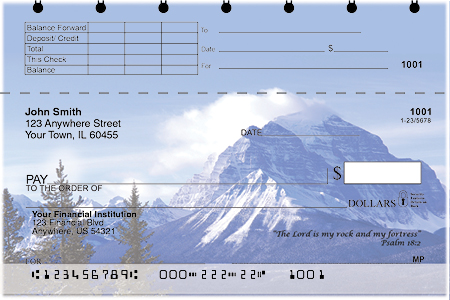

All checks, whether top stub checks or side tear checks have the same composition which include the following:

* Bank details – have your existing checks ready so you can see the bank details that need to be included. Typically, this includes the name of your bank, with the address being optional.

* Check customization – these are normally five lines that you can customize to suit your needs. These can consist of your name, address, name of spouse, license number (not recommended), and your contact numbers.

* Bank routing number – this is made up of nine numbers that always begin with a 0, 1, 2, or 3. This is the first number found on the MICR line located at the lower portion of your checks.

* Check number – this sequential number allows for easy monitoring of all checks that you use. It is found on both your checks’ upper right-hand portion and MICR line.

* Bank account number – this number can be found either after or before the check number located in the MICR line.

* Signature line – this is found on the lower portion of the check. This is where you put your signature when you write out a check.

* Text area for Over Signature – in most instances, depending on the check design that you chose, you can include a customized message to appear on top of your signature line.

* Monogram or Cut area – depending on the chosen design for your checks, you can also include a monogram or special cut on the left side of the check customization.

* ‘Pay To’ line – this is the line where you write the name of the specific individual or business you want your check written to.

* Amount line – this line is where you write the amount of the check.

* Dollars box – this is where you put the check’s amount in numeric format. Typically, this is written alongside the amount line that is normally found below the check’s ‘Pay To’ line.

* Padlock image – the padlock image represents your check’s security elements to aid your bank in verifying cases of check fraud.

* Fraction – this is utilized for identifying your financial institution.

• Common Online Order Questions

* How do I order top stub checks?

1. begin by choosing an item category, in this case, personal or business top stub checks

2. choose your desired design

3. choose the items from the specific design you want to purchase

4. add the items to your shopping cart

5. continue shopping for other items or go on to complete the checkout process

* Can I check the order status of my checks?

To check the status of the checks you ordered, you can use your order number that was sent to you along with the confirmation message you received in your email after completing your transaction. In general, check printers provide a webpage where you can input either your order number or checking account details (to verify that you are indeed yourself) after which a summary of your order status will be presented. In addition, you can call or email the check manufacturer to track your order status.

* Will the checks include the updated specifications of my bank?

Once you get wind of changes in your bank’s operations, name, or alliances among other things, you can tell the check manufacturer to confirm if their information regarding your bank is updated. More often than not, check companies are privy to things like these and will have updated information regarding your bank.

On the other hand, the printer will help you acquire an MICR specification sheet if their database has not been updated yet. This is a form that will provide you with accurate spacing and numbers so that your ordered checks can be properly scanned by your bank.

* Can I put additional details on my checks such as contact numbers or license number for instance?

In the provided check customization portion of your checks, you can include your contact numbers and other information. However, check manufacturers advise against including your driver’s license number in your checks for your own protection.

Keep in mind the above mentioned information and considerations for fast and easy online ordering of top stub checks.