Checks For Business

Business Checks: Security Features And Others

Business checks are used by businesses instead of personal checks which are used by the average person. The funds for a business check is sourced from the business’s checking account and is normally utilized for paying vendors, suppliers, and other services associated with a business’s general operations.

Business checks may likewise be used for a company’s payroll service where checks issued from the account will be used strictly for handing out the employees’ paycheck. Normally, the funding used for the payroll is different from the business’ main account used for daily operations. Although all types of checks come with security features, more often than not, financial institutions provide additional security measures for business check account holders because of the serious nature of their check transactions. Below are some of the most widely used security features commonly incorporated in business checks:

• Chemical detection box – a white, chemical wash portion on the checks’ backers that makes any alteration visible.

• Extended and Primary Chemical reactive check paper – a chemically treated paper that will show signs when altered with chemicals.

• Colored pantograph – this background has a unique color characteristic which can only be seen in authentic checks.

• Heat sensitive ink – located in one or various sections of a check, this treated section will change colors when subjected to heat as is a common practice when chemically tampering with checks.

• Fugitive ink – this chemical reactive ink is utilized for printing the check backer and will show a noticeable portion when altered with chemicals.

• Foil hologram – a 3D graphic foil cleverly entrenched in the business check to offer extra protection from malicious individuals.

• Invisible fluorescent fibers – these invisible fibers are used for easy verification of a check’s authenticity if seen from either the front or back side with a black ultraviolet light.

• High-res border – this border is incorporated with very intricate designs to make it more difficult for scammers to duplicate a check.

• Micro-printing – the check backer, border, as well as the signature line offers authentication when seen under a magnifying instrument.

• Multicolored prismatic background – a background infused with multiple color combinations with understated gradations to make reproduction and duplication harder.

• Padlock image – this image is an indication that your business check either meets of surpasses industry requirements.

• Security weave – the security weave is unique to every check manufacturer and is found on the back. It includes an intricate and complex design that prevents scanning and duplication.

• Security screen backer – this is a specific word incorporated in the check backer that will disappear, fade, or deform when the check is scanned or duplicated.

• Pantographic box – a specific word typically found near and embedded on the signature line portion. This word will be visible if the check is photocopied.

• Heat-reactive thermochromic image – the ink used for this image can’t be applied via traditional copiers so authentication is easy to do.

• Toner adhesion – this offers an extra level of protection to your business checks to make certain that toner used can’t be simply removed from the check without doing obvious damage to it.

• Ultraviolet dull paper – offers a comparison method for conventional copy papers against authentic checks.

• Void – specific background designs and screens are embedded throughout the check. In the event that the check is photocopied, the ‘Void’ word will be visible.

• Warning box – this box is located at the back portion of checks and provides a list of the check’s security features that payees can use for authenticating a check before presenting it to the bank.

• Warning band – this is located in the front portion of the check and like the warning box, helps users how to authenticate checks.

• Visible fibers – fibers in random colors and lengths are incorporated into the back and front portions of the check which make duplication more difficult.

Writing Business Checks

When writing a business check, you should always remember to utilize a pen to avoid alteration. You must also make sure to write all details clearly and accurately so that the recipient won’t have issues cashing it in.

1. Fill in the date line located on the upper portion of the check. The date should be the same date as the date you are writing the check. In the event that your check does not have preprinted check numbers, number the checks first accordingly. Checks with preprinted numbers are useful and convenient for easy monitoring of all your check transactions.

2. Fill out the pay to line. For this, you should write the complete name of the individual or the company you are writing the check to. To illustrate, if you’re writing the check to United States Business Incorporated, you can’t just write down U.S. Bus. Inc. This will avoid any hassles when the recipient cashes the check.

3. Write down clearly the payable check amount in numbers and in words. Remember not to use abbreviations for this as well. The receiving financial institution will refer to both number formats to make sure that the check will be cashed in the right amount. Delays will occur if there are any errors with the written check amount.

4. Make sure to fill in the check’s memo section with the proper details such as if you’re paying a supplier, indicate the order number, transaction number, or something similar. Likewise, if you’re writing a check to be deposited to another checking account, include the account number. Consult with the payee first if inclusion of the complete account number is required since some won’t allow putting the entire account number for safety reasons.

5. The last step is to write your signature. Remember to sign your business checks by hand and with ink even if you make use of software applications for writing checks.

| Custom Designs!

Build your own checks, use family photos, pictures of your dog, your favorite team’s logo, it doesn’t matter! Have fun! |

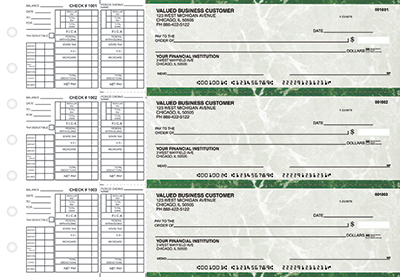

Green Marble Payroll

These Payroll Business Checks come Three-On-A-Page and are designed to fit a 7-ring binder. For first time orders customers can receive a free binder with purchase of checks. |

Vinyl Cover Burgundy

This vinyl checkbook cover is thicker than most covers. The cover comes with a duplicate flap built in for duplicates checks. Choose from over 12 different colors including clear! |

| Red Leather

This great red leather checkbook cover is filled with features. This leather cover is lined on the inside in a matching fabric. The cover also comes with a built in duplicate check writing shield and 6 credit card slots, a windowed slot, and a pen holder. |

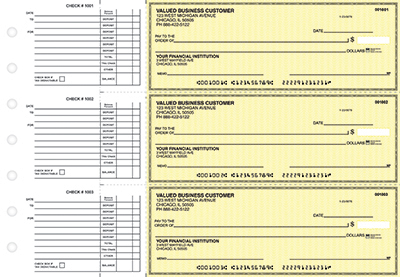

Yellow Safety Accounts

These Multi Purpose Business Checks come Three-On-A-Page and are designed to fit a 7-ring binder. |

Vinyl Cover Neon Purple

This vinyl checkbook cover is thicker than most covers. The cover comes with a duplicate flap built in for duplicates checks. Choose from over 12 different colors including clear! |

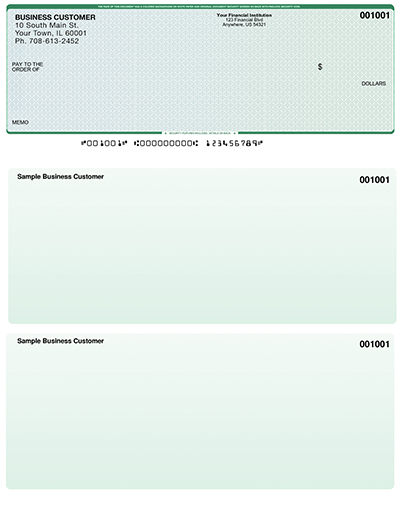

| Blue Green Laser Business

We here at Carousel Checks are pleased to be able to offer these check on top laser checks at everyday low prices. All of our checks meet and exceed specifications required by the American Bankers Association, and are guaranteed acceptance by all financial institutions. |

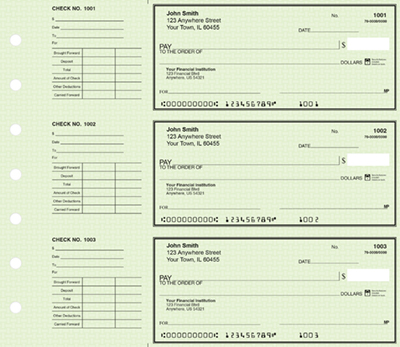

Deskset Green Safety

These Deskset Checks, or Desk Checks come Three-On-A-Page and are designed to fit a 7-ring binder. The checks detached are 6″ x 2-3/4″ and with the stub: 10-1/2″ x 2-3/4″. Included with your order are 30 deposit tickets per 300 checks ordered. |

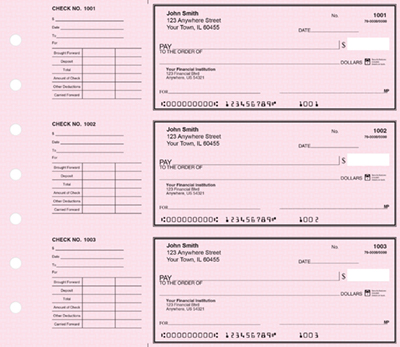

Deskset Pink Safety

These Deskset Checks, or Desk Checks come Three-On-A-Page and are designed to fit a 7-ring binder. The checks detached are 6″ x 2-3/4″ and with the stub: 10-1/2″ x 2-3/4″. Included with your order are 30 deposit tickets per 300 checks ordered. |